car lease tax write off

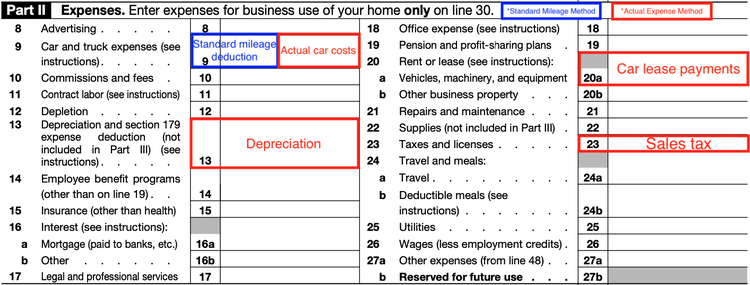

If you are a sole proprietor report your automobile lease expense deduction on Form 1040 Schedule C Line 20a. According to the IRS you can include gas oil repairs tires insurance registration fees licenses and lease payments for the portion of miles that were business-related.

Is It Better To Buy Or Lease A Car Taxact Blog

Tax purposes but fiscally transparent from a US.

. The business use of a vehicle gives you deductible expenses but it is not as simple as just using the monthly payment as a write-off. We Are Always Interested in Purchasing or Consigning Your Classic Vehicle. Delivery type vehicles such as classic cargo vans or box trucks with no passenger.

To write off a car lease with an LLC figure out the mileage you will cover estimate the IRS standard mileage deduction add up vehicle-associated costs during the lease and apply a car lease write-off method. Most individuals in the real estate industry are self-employed even if they work for real estate agencies. The deduction is based on the portion of mileage used for business.

Deductible expenses include your annual lease payment total license fees gas maintenance costs insurance tires parking fees and tolls. The interest expense generated by USS via DRE is offset by USP s interest income resulting in a wash from a US. Parking fees and tolls are also deducible regardless.

Fuel and oil costs. Not bad at all. Interest on money borrowed to buy a motor vehicle.

If you lease a new vehicle for 400 a month and you use it 50 of the time for business you may deduct a total of 2400 200 x 12 months. DRE is a hybrid entity ie a corporation for non - U S. Here are the qualified vehicles that can get a Section 179 Tax Write-Off.

Payment is determined by location of shoot length of shoot and use of your vehicle. The tax rules offer a choice of vehicle expense deduction methods and if you itemize the vehicle expenses a portion of a lease payment can be used as a business expense. Its GVWR meets the criteria for the accelerated vehicle tax deduction with a weight of 6834 to 7077 lbs.

If a taxpayer uses the car for both business and personal purposes the expenses must be split. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. When getting a mortgage the qualifying.

Licence and registration fees. The types of expenses you can claim on Line 9281 Motor vehicle expenses not including CCA of Form T2125 or Form T2121 or line 9819 of Form T2042 include. If accelerated this car can give you a tax deduction of 92000 in the first year.

Heavy SUVs Vans and Pickups that are more than 50 business-use and exceed 6000 lbs. And you cant miss both. The tax write-offs for being self-employed help save a ton of money when filing income taxes.

Say your business use is 60 percent and you are making a monthly payment of 400 on it. You would just need to multiply the sale price of the car by the rate given for your New York home address. On top of that if theres an upfront cost or.

There are two things certain in life death and taxes. Calculating New York auto sales tax can be tricky. Tax perspective assuming no other limitations apply eg dual - consolidated - loss limitations.

You have a very. Report and deduct car lease sales tax on Schedule C Form 1040. If you purchase a vehicle from a dealership and there are manufacturer incentives and rebates associated the auto tax you will pay is determined by the sale price before the reduction.

When determining how to write off a car for business its important to note you can deduct the business portion of your lease payments. Feb 8 2022 3 min read. You can write off 240 for.

For more info give us a call at 212-929-3909 or. Or should I put money down and finance a vehicle with monthly payments being around 350. Additional benefits are increasing the vehicles provenance value possible tax write-offs and seeing your vehicles in print or on film.

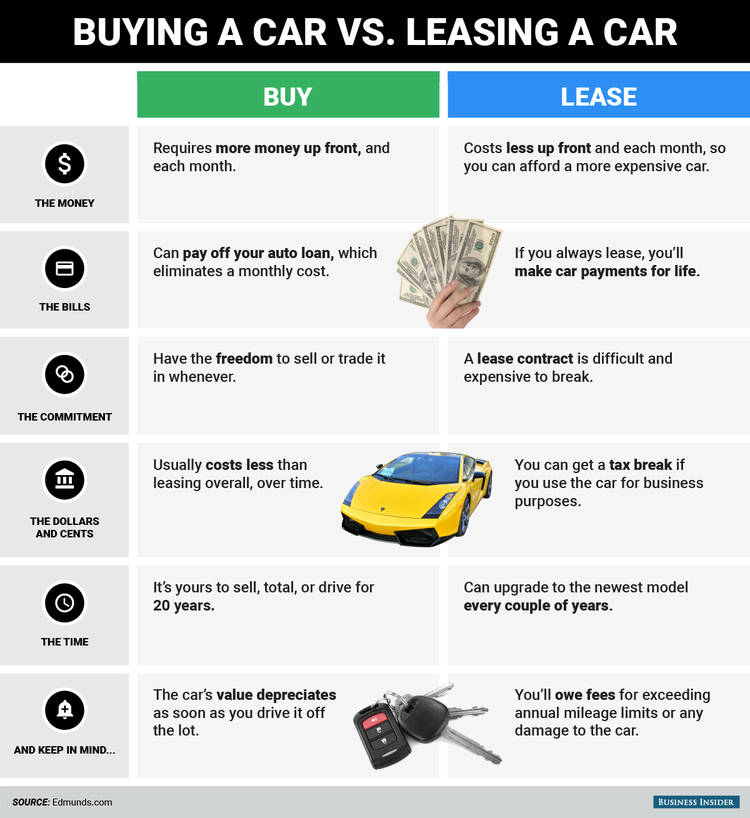

If you have incorporated you business report it as part of Other Deductions on Form 1120 Line 26 or Form 1120-S Line 19. However those write-offs may not be so great when qualifying for a home loan. Leased car payments can be a personal or a business lease car depreciation does not apply to leased vehicles only works for new cars The actual cost method relies on the percentage of the business portion of the car usage.

Business owners and self-employed individuals. But one thing you can be sure of you can save a whole lot of money if you. So if I lease a car with monthly lease payments being around 450 which yearly accumulates to around 5400 how much of that would I be able to write off on taxes since Im a real estate agent in Canada.

Gross vehicle weight can qualify for at least partial Section 179 deduction and bonus depreciation. You can write off work-related expenses by either deducting the standard mileage rate or by deducting actual expenses. Would leasing be the best option.

Is It Better To Buy Or Lease A Car Taxact Blog

Are Car Lease Payments Tax Deductible Lease Fetcher

Is Your Car Lease A Tax Write Off A Guide For Freelancers

.jpg)

Financing And Leases Tax Treatment Acca Global

Vehicle Tax Deductions Writing Off A Vehicle For Business Using Section 179 Depreciation Youtube

How To Write Off A Car Lease For Your Business In 2022

How To Write Off Vehicle Payments As A Business Expense

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

Is It Better To Buy Or Lease A Car Taxact Blog

How To Take A Tax Deduction For The Business Use Of Your Car

Writing Off A Car Ultimate Guide To Vehicle Expenses

Is Your Car Lease A Tax Write Off A Guide For Freelancers

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Is Leasing A Car Tax Deductible Money Donut

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

.jpg)