vanguard high yield tax exempt fund review

See Vanguard High Yield Tax Exempt Fund performance holdings fees. See Vanguard High Yield Tax Exempt Fund VWALX mutual fund ratings from all the top fund analysts in one place.

The Fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors principal.

. Vanguard High-Yield Tax-Exempt Bond is relatively conservative compared to other muni strategies sporting the high-yield label so much so that it lands in the muni. Ad Create Bond Strategies With Our True-To-Label Actively-Managed Low-Cost Funds. Investment market cap and category.

Vanguard and Morningstar Inc as of December 31 2020. Vanguard High-YieldTax-Exempt Fund Investor Shares VWAHX Vanguard High-YieldTax-Exempt Fund Admiral Shares VWALX The Funds statutory Prospectus and Statement of Additional. Vanguard High-Yield Tax-Exempt Fund Admiral Shares - Fund Profile.

Some vanguard fixed-income funds have consistently outperformed their benchmarks and provide multiple benefits to investors with their low fees and other. 16 2022 the funds 30-day SEC yield is. See Vanguard High Yield Tax Exempt Fund performance holdings fees.

Get the lastest Fund Profile for Vanguard High-Yield Tax-Exempt Fund Admiral Shares from Zacks. Dec 31 2021 VWALX. See Vanguard High Yield Tax Exempt Fund VWAHX mutual fund ratings from all the top fund analysts in one place.

The Fund seeks to provide investors with a high level of current income exempt from Federal income taxes primarily through investment in high. Ad This guide may help you avoid regret from making certain financial decisions. The Vanguard High-Yield Tax-Exempt Fund has an average maturity of 182 years making it sensitive to interest rate risk.

Find our live Vanguard High-yield Tax-exempt Fund fund basic information. 16 2022 the funds 30-day SEC yield is. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

A high-level overview of Vanguard High-Yield Tax-Exempt Fund Inv VWAHX stock. The Fund invests at least 80 of its assets in longer-term. Names can be deceiving.

Ad Create Bond Strategies With Our True-To-Label Actively-Managed Low-Cost Funds. - The Fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors principal. The Fund invests at least 80 of its assets in longer-term.

The Vanguard High-Yield Tax-Exempt Fund has an average maturity of 182 years making it sensitive to interest rate risk. Bond funds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because. French fries arent really French and Vanguard High-Yield Tax-Exempt fund symbol VWAHX isnt a high-yield bond mutual fundIn the bond.

Stay up to date on the latest stock price chart news analysis fundamentals trading. View analyze the VWAHX fund chart by total assets risk rating Min. Vanguard Tax-Exempt Bond offers a broad portfolio of investment-grade tax-exempt municipal bonds at an attractive price earning a Morningstar Analyst Rating of Gold.

Vanguard High Yield Tax Exempt Don T Call It Junk Kiplinger

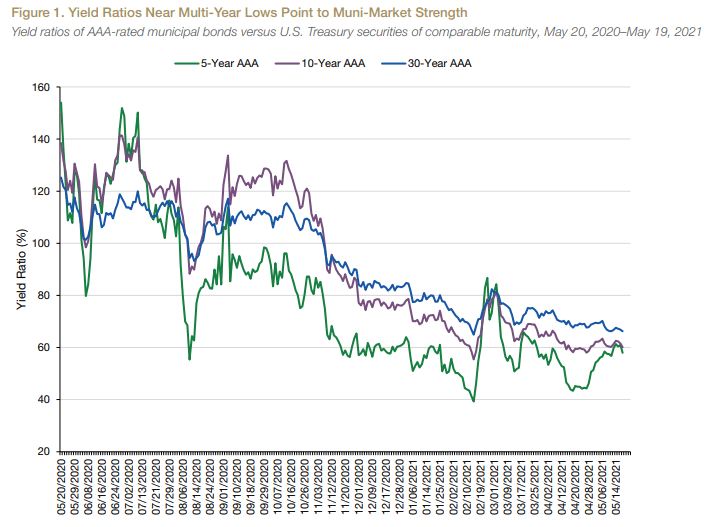

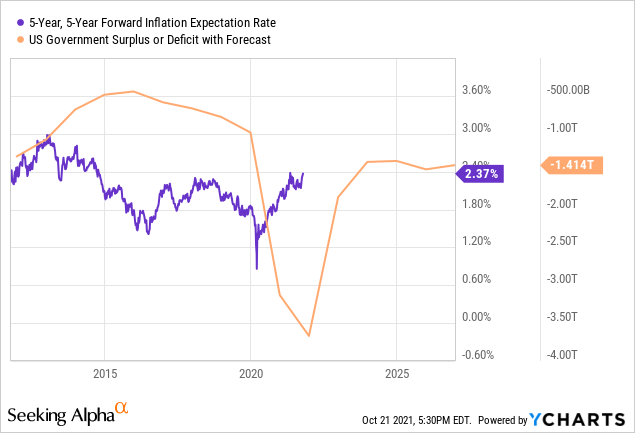

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

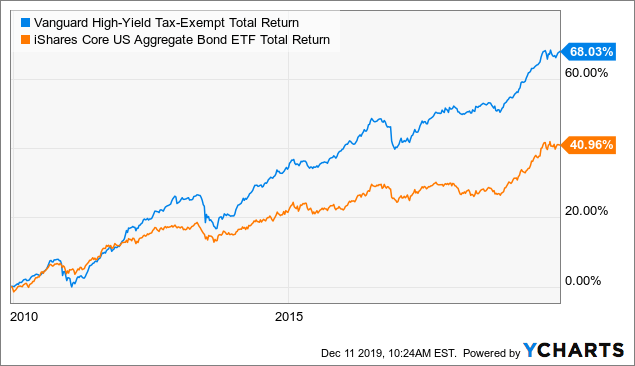

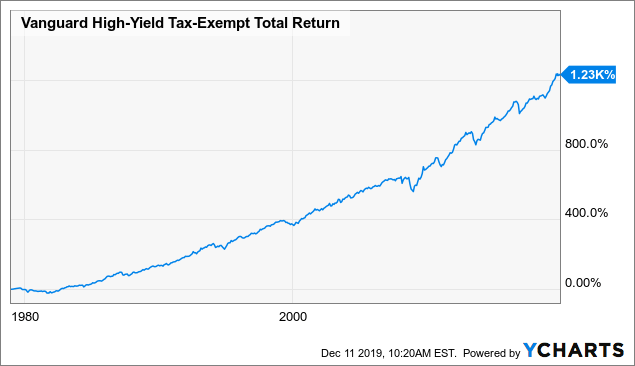

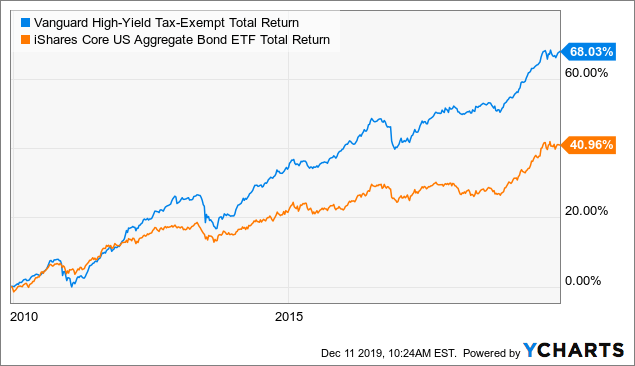

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha

Free Trend Analysis Report For Vanguard High Yield Tax Exempt Fund Admiral Shares Vwalx Marketclub

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha